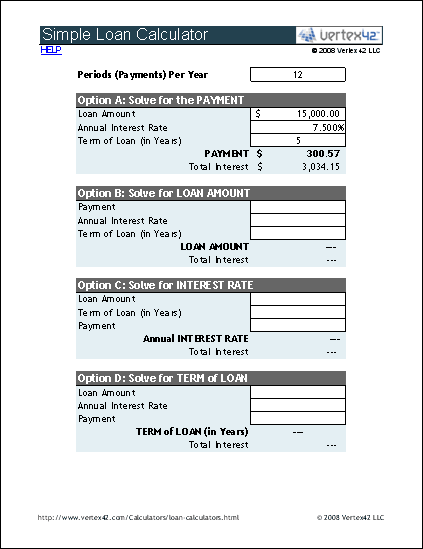

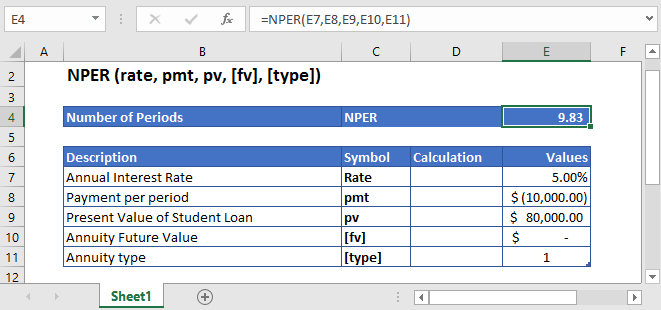

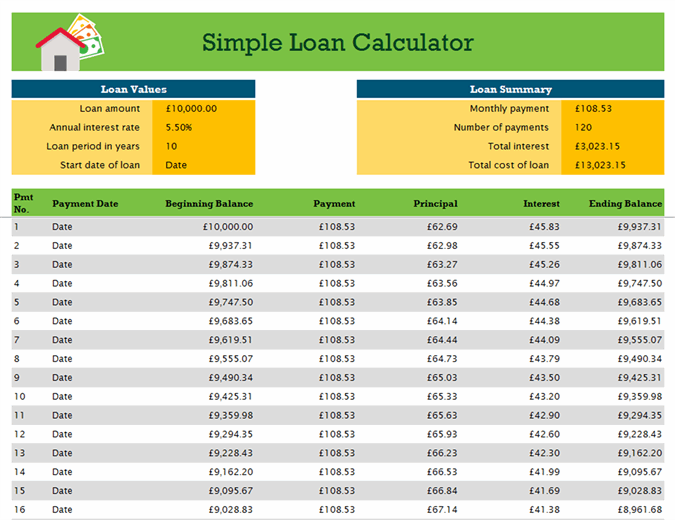

Most commonly this type of loan is taken for a vehicle loan, personal loan, study loan, and small project loan.Īnother common example of an amortization loan for employees is the P.F loan. It is commonly known as an amortized loan. However, if a loan is taken with scheduled and periodic payments. So, it means the money has to be returned within the defined period. If you have any comments, or suggestions for enhancing the calculator, please let me know in the comments.A loan is the amount of money borrowed from someone with defined terms and conditions. The calculator uses the IFERROR function, so you’ll need to change that if using an earlier version of Excel. The file is in Excel 2007 format, and zipped. In the Download section, click the link to get the Enhanced Loan Payment Calculator. To see the formulas, and experiment with the calculator, go to the PMT function page on my Contextures website. You can omit the minus sign, to show the payment as a negative number.ĭownload the Excel Loan Payment Calculator

I added a minus sign before the present value variable, so the monthly payment is shown as a positive number. The payment amount is calculated with the PMT function: The Lists sheet has a lookup table of frequencies and number of payments.īased on the frequency that you select, a number of payments per year is calculated in cell E5, using a VLOOKUP formula. Type in any cell, except Payment Frequency, where you can select from a drop down list of options. Of course, if you are the Bank of Dad, you might offer a lower interest rate, so you can adjust any, or all, or the green cells. It uses the PMT function to calculate the payment amount, and you can enter the variables:

(The kids will think you’re cool when you say “nifty”.) (Oh yes, they will stick to the plan, without fail.) To help you figure out the payment amounts, here is a nifty Excel loan payment calculator. Can you afford that new car? Or maybe you loaned money to one of your kids, and you want to calculate a repayment schedule.

0 kommentar(er)

0 kommentar(er)